Is is better to pay off debt or save may feel like your only financial concern.

However, while paying off your debt, you should save some money. Even a tiny emergency fund can save you from going farther into debt when an unforeseen expenditure arises. And you don’t want to pass up free money from an employer match on retirement savings if it’s available.

Is it better to pay off debt or save

Better saving now

Paying off your debt is critical, but so is developing monetary resiliency and strategizing for the future. Take these two small first actions before tackling toxic debt:

Build your emergency funds.

Even a little emergency fund might help you stay financially stable when a crisis strikes. NerdWallet recommends starting with a $500 emergency fund and gradually increasing your reserves.

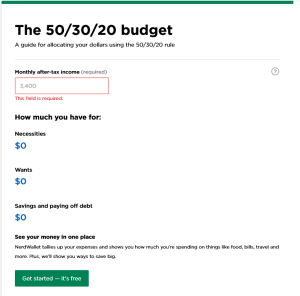

Use the 50/30/20 budget to help you arrange your funds and accumulate savings. With this strategy, half of your salary is allocated to necessities such as housing, groceries, and transportation. The remaining 30% is spent on wants such as entertainment and dining out, with the remaining 20% going toward debt repayment and savings. Depending on your debt level and income, you may wish to reduce your wants while increasing your debt payments and savings.

Here’s a chart

If you’ve previously failed to budget for savings, consider the “pay yourself first” strategy, which involves setting up a direct deposit to send a percentage of your income into a savings account rather than saving what’s left over at the end of the month.

Consider keeping your emergency fund in a high-yield savings account. These accounts are free to open and offer higher interest rates than ordinary checking accounts.

Nab employer match money

Retirement might be the last thing on your mind when facing the urgency of paying off debt.

But if your employer offers a match in a tax-advantaged account such as a 401(k), contribute enough to meet the maximum match. That’s free money.

Doing this now is important because you can’t get this match retroactively. Plus, amassing what you need for retirement depends heavily on the effect of compound interest over a long time period; getting a late start will cut into your ability to afford retirement.

Wipe out toxic debt first

Once you get your basic savings established, focus on paying off your toxic debts, like payday loans, credit cards with interest rates higher than 15%, car title loans and rent-to-own payments.

You should focus on these first because their high interest rates can eat up your budget and create a spiral of debt.

A debt payoff calculator will let you see when you’ll get out of debt with your current payments and how much faster you could ditch debt if you pay more each month.

Tip: Check out debt snowball and debt avalanche payoff methods to see which is right for you.

It’s also important to know when you might need help. You might be a good candidate for debt relief if:

-

You are struggling to meet your minimums and see no way to resolve your debt in five years.

-

Your total unsecured debt is greater than half your gross income.

Tools like a debt management plan from a nonprofit credit counseling agency or Chapter 7 bankruptcy can help you retire your debts faster.

Next, balance more savings and remaining debt

With your toxic debt under control, you can turn to building up greater cash reserves and retirement savings while working to pay off the rest of your debt.

If you’re putting just enough into your 401(k) to get the match, you can add more. Work up to saving 15% of your gross income toward retirement.

Tip: If your workplace doesn’t offer a plan, you have other ways to save for retirement, such as an individual retirement account.

Student loans, credit cards with interest rates of 15% or lower, or auto loans may be easier forms of debt to manage, but it’s still important to make a plan to repay what you owe.

When to prioritize debt repayment

When you have high-interest consumer debt, paying it down first can help you solve ongoing problems with managing your money. The more you reduce your principal and the amount of interest you owe, the more money you’ll have in your budget each month to devote to savings or other line items.

Get started with repaying your debt by following these four steps:

- Calculate your expendable income. This is what’s left over after you pay for housing, utilities, transportation, food, and so on.

- List your regular expenses. Include everything from monthly bills to things you pay for less than once a month. See if there’s anything you can reduce or eliminate.

- Create a budget based on your income and expenses. Include line items for any and all monthly debt repayments.

- Identify financial goals and add them to your budget. Create line items for anything from saving for a down payment on a house to saving for a vacation.

Tara Alderete, director of education and community at Money Management International, says it usually makes sense to prioritize debt reduction overall, but there are exceptions.

“If you already have adequate savings in your emergency fund, you may want to focus on quickly eliminating debt,” Alderete says. “However, if you find yourself making only minimum payments on debts with extremely high interest rates, those debts may be causing you to lose money and preventing you from achieving your overall financial goals, and you may want to focus on paying off that costly debt.”

As Alderete sees it, an important part of building a budget is focusing on your priority expenses first, so that you can free up money to put toward a debt reduction plan while hopefully still being able to contribute to an emergency fund.

Reduced income on saving money

The average forecast of top economists puts the odds of a recession between now and July 2024 at 59 percent, according to Bankrate’s survey. That could potentially mean slower hiring and more unemployment in the coming year.

If you find yourself laid off from work, you can expect to spend around five to six months searching for a new job, according to some reports.

Another common enough reason for finding yourself with reduced income is switching to a new job that earns less money than your previous job brought in.

Continued high prices checks to pay off debt

Inflation rose 3.2 percent in July 2023 from a year prior, as measured by the Consumer Price Index (CPI). Last year, in June 2022, the CPI was rising by over 9 percent.

Inflation has slowed, with the efforts of the Federal Reserve to slow the economy, but prices — particularly in services and housing — are still uncomfortably high.

Although high prices and the high cost of borrowing can eat into your budget, rates are also high on savings accounts. That means there’s a potential for you to earn more in return on your savings.